Gerda og Victor B. Strand Holding A/S

Annual Report

2024

Henrik Brandt

Chairman of the General Meeting

Date: 4 April 2025

Registration no.: 35 04 30 55

Toms Allé 1,

2750 Ballerup

Denmark

Company details

Gerda og Victor B. Strand Holding A/S

Toms Allé 1, 2750 Ballerup, Denmark

| Telephone: | +45 44 89 10 00 |

| Fax: | +45 44 89 10 99 |

| E-mail: | [email protected] |

| Website: | www.tomsgroup.com |

| Registered office: | Ballerup |

| Registration no.: | 35 04 30 55 |

| Established: | 1 February 2013 |

| Financial year: | 1 January – 31 December |

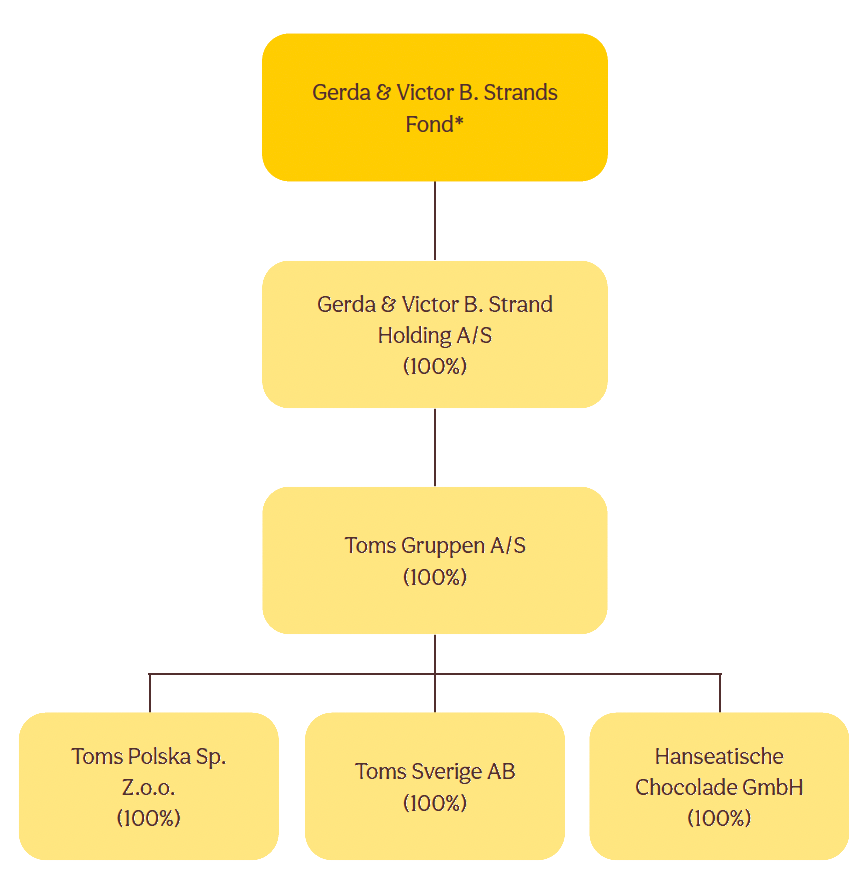

Ownership

Gerda og Victor B. Strand Holding A/S is a fully owned

subsidiary of Gerda & Victor B. Strands Fond

Group companies

Toms Gruppen A/S

Toms Allé 1, 2750 Ballerup, Denmark

Toms Sverige AB

Hamngatan 17, 302 43 Halmstad, Sweden

Toms Polska Sp. z o.o.

Ul. Okrezna 27, 64-100 Leszno, Poland

Hanseatisches Chocoladen Kontor GmbH & Co. KG

An der Reeperbahn 10, 28217 Bremen, Germany

*) This entity is not included in this Annual Report.

Revenue 2024

DENMARK/SWEDEN 64%

GERMAN 13%

OTHER 23%

GROUP EMPLOYEES

(2023: 902)

GROUP REVENUE

(2023: DKK 1,661 million)

Our values - the four C’s

Courage

Creativity

Collaboration

Commitment

Five years overview

Financials | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

Results (DKKm) | |||||

| Revenue | 1,683.5 | 1,660.9 | 1,613.0 | 1,450.7 | 1,253.7 |

| Gross profit | 443.6 | 457.4 | 470.6 | 419.2 | 282.4 |

| Operating profit before special items * | 98.0 | 97.6 | 99.1 | 80.3 | -3.3 |

| Operating profit | 82.5 | 49.8 | 95.3 | 75.1 | -26.0 |

| Net financials | -6.0 | 21.3 | -8.3 | -22.4 | -40.8 |

| Profit/loss before tax | 167.1 | 71.1 | 87.0 | 52.7 | -66.8 |

| Profit/loss for the year | 123.2 | 54.3 | 71.9 | 56.0 | -58.6 |

Financial position (DKKm) | |||||

| Non-current assets | 736.3 | 790.4 | 775.9 | 818.1 | 830.4 |

| Current assets | 813.0 | 694.8 | 616.5 | 564.9 | 486.4 |

| Total assets | 1,549.3 | 1,485.2 | 1,392.4 | 1,383.0 | 1,316.8 |

| Share capital | 10.0 | 10.0 | 10.0 | 10.0 | 10.0 |

| Equity | 1,037.0 | 908.4 | 837.4 | 763.8 | 703.1 |

| Provisions | 67.8 | 103.8 | 63.0 | 52.8 | 46.1 |

| Long-term debt | 154.2 | 164.1 | 170.3 | 178.7 | 187.2 |

| Short-term debt | 290.3 | 308.9 | 321.7 | 387.7 | 380.4 |

| Total liabilities and equit | 1,549.3 | 1,485.2 | 1,392.4 | 1,383.0 | 1,316.8 |

Cash flow (DKKm) | |||||

| Cash flow from operating activities | 105.7 | 88.2 | 11.1 | 213.0 | 101.6 |

| Cash flow from investment activities | 53.4 | -44.4 | -48.4 | -49.7 | -106.9 |

| Of this investments in property, plant and equipment | -38.0 | -50.3 | -48.4 | -49.3 | -106.0 |

| Cash flow from financial activities | -20.1 | -17.1 | -16.8 | -72.3 | 4.6 |

| Total increase/decrease in cash and cash equivalents | 139.0 | 26.7 | -54.1 | 91.0 | -0.7 |

Ratio | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

Financial ratios** (%) | |||||

| Growth in operating profit before special items | 0.4 | -1.6 | 23.4 | n/a | n/a |

| Operating margin | 4.9 | 3.0 | 5.4 | 4.7 | -1.9 |

| Return on invested capital | 8.3 | 5.1 | 10.5 | 8.5 | -2.7 |

| Adjusted return on invested capital | 9.9 | 9.9 | 11.0 | 9.1 | -0.3 |

| Gross margin | 26.3 | 27.5 | 35.7 | 35.6 | 30.6 |

| Current ratio | 280.1 | 224.9 | 191.6 | 145.7 | 127.8 |

| Solvency ratio | 66.9 | 61.6 | 60.1 | 55.2 | 53.4 |

| Return on equity | 12.7 | 6.2 | 9.0 | 7.6 | -7.9 |

| Average number of employees | 841 | 902 | 919 | 928 | 933 |

*) Special items are disclosed in note 1 to the financial statement.

**) Refer to definitions of financial ratios, etc. Click here.

Operating profit before special items

No Data Found

Adjusted return on invested capital

No Data Found

Management’s Review

Financial highlights

Principal activities of the Company

Gerda og Victor B. Strand Holding A/S is a holding company. Toms Gruppen A/S manufactures, markets and sells confectionary.

Denmark is the largest market, including sales to Danish/ German border shops. Mainly branded products are sold in Denmark, and Toms Gruppen A/S is the market leader across the confectionery category as a total.

In Germany, sales mainly consist of premium chocolate under the brands of Hachez, Feodora and Anthon Berg.

In Sweden, sales consist of Pick-and-Mix sweets as well as branded products like Anthon Berg and Toms.

The international business mainly exports to the markets in North America, Europe and Asia. In several markets, sale is handled through distributors. The business unit is also responsible for sales to the travel retail market.

All production takes place at the Group’s own three factories in Denmark, Ballerup and Helseholmen and Poland, Nowa Sól, as well as a packaging facility in Poland, Leszno.

Revenue

No Data Found

Gross margin

- 22.5%

- 28.9%

- 29,2%

- 27,5%

- 26,3%

No Data Found

Free cash flow

No Data Found

Net working capital

No Data Found

2025 Outlook

We expect continued pressure on our margins in 2025, mainly driven by significant increases in cocoa market prices. We expect revenue growth to be in the range of 10-15%, driven by required price increases and entailing volume pressure. Operating profit before special items in the following range: DKK 105 million – DKK 115 million is expected.

General risks

The Group’s main operating risks are attributable to the development of the consumer trends and the competitive environment in the retail market. In addition, risks are associated with the following: fluctuations of market prices of cocoa and other significant raw materials and future uncertainties related to macro-economic risks. In relation to recent announcement of closing the production operations in Ballerup, Denmark, the Group is exposed to the risk of retaining key employees.

Particular risks

Data Ethics

The only activity in the company is to own all shares in Toms Gruppen A/S. As the company does not process or store data covered by the data ethics politics requirements, it has been decided not to implement a data ethical politic.

Financial risk management

The Group is exposed to several financial risks, mainly within currency risk, arising from the operating and financing activities. The risks are an inherent part of the Group’s operating and financial activities. However, through effective risk management, below mentioned risks are monitored and mitigated to a reasonable level with low impact on the financial statements for the Group.

Equity and solvency

- Solvency ratio

- 53%

- 55%

- 60%

- 61%

- 67%

No Data Found

Statement by the Board of Directors and the Executive Board

Statement by the

Board of

Directors and

the Executive Board

The Board of Directors and the Executive Board have today discussed and approved the Annual Report of Gerda og Victor B. Strand Holding A/S for the financial year 1 January – 31 December 2024.

The Annual Report has been prepared in accordance with the Danish Financial Statements Act.

It is our opinion that the consolidated financial statements and the parent company financial statements give a true and fair view of the Group’s and the Company’s financial position at 31 December 2024 and of the results of the Group’s and the Company’s operations and consolidated cash flows for the financial year 1 January – 31 December 2024.

Furthermore, in our opinion, the Management’s review gives a fair review of the development in the Group’s and the Company’s operations and financial matters and the results of the Group’s and the Company’s operations and financial position.

We recommend that the Annual Report be approved at the Annual General Meeting.

Ballerup, 4 April 2025

Executive Board

Annette Zeipel

CEO

Claus Rosthof

CFO

Board of Directors

Henrik Brandt

Chairman

Carsten Bennike

Vice Chairman

Peter Giørtz-Carlsen

Vice Chairman

Jesper Terndrup Madsen

Anuradha Chugh

Martin Schlatter

Torben Klyhn Andersen

(E)

René Brink Hansen

(E)

Klaus Toxborg Petersen

(E)